Key Takeaways:

- Adequate time and task management can significantly improve productivity and reduce stress for tax professionals.

- Utilizing digital tools and software can streamline processes and enhance organization.

- Developing personalized techniques and habits can lead to long-term success and efficiency in managing tax-related tasks.

This article delves into the essential tools and techniques tax professionals can use to enhance productivity and streamline workflow. By adopting these strategies, professionals can ensure they meet deadlines, reduce stress, and maintain a high standard of service for their clients by Tax Law Advocates.

Understanding the Importance of Time Management for Tax Professionals

Time management is not just about having a good schedule or timetable but also about making the most of the time and ensuring every activity is done perfectly within the set time. For tax professionals, it entails appraising consultations with clients, preparing tax documents, and studying and understanding new tax laws and policies. Effective time management enables the professional to spend adequate time researching, meeting the clients, and preparing tax documentation carefully.

In a time management system, priority plays a vital role since time is scarce and has to be allocated effectively. Hence, the level of each task would help the tax professionals prioritize the time and effort spent on the task. This prioritization also helps organize work, especially when there are tight schedules, such as during a compressed tax calendar and ensures that deadlines are met with equal efficiency and quality.

Essential Tools for Task Management

Effective task management is crucial for tax professionals who must manage multiple clients, deadlines, and compliance requirements. The right tools can streamline processes, enhance productivity, and reduce the risk of errors.

Digital Calendars and Scheduling Apps

Technology tools like digital calendars or scheduling applications like Google, Microsoft Outlook, etc., are essential to a tax professional’s toolkit. These tools allow one to fix appointments, set reminders, and track when certain events are due.

Some of the application’s prominent aspects include color-based organization and compatibility with other programs to offer users a complete picture of their responsibilities and timelines. Moreover, these tools have mobile counterparts; therefore, the schedules can be pulled out and edited on the go.

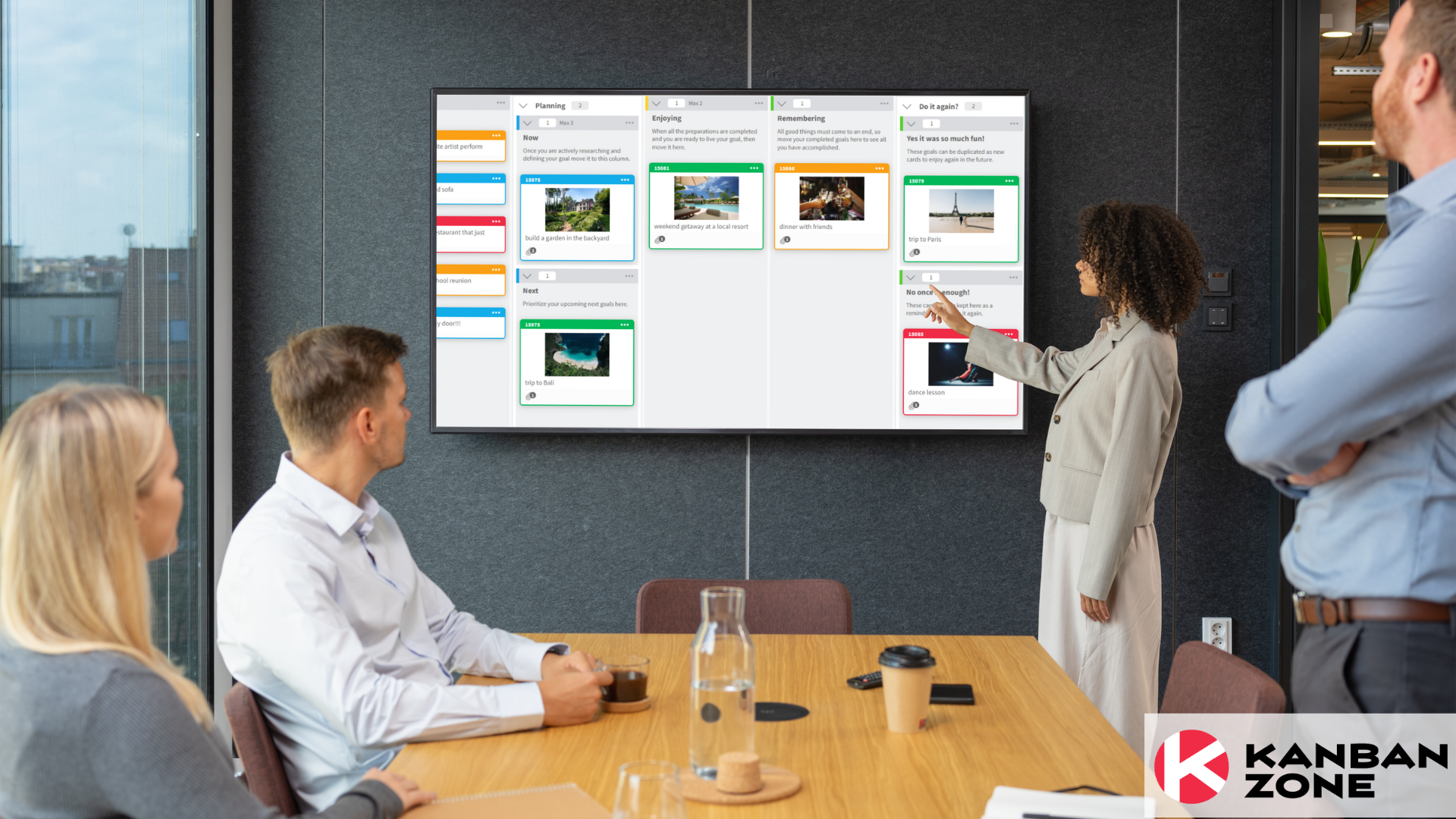

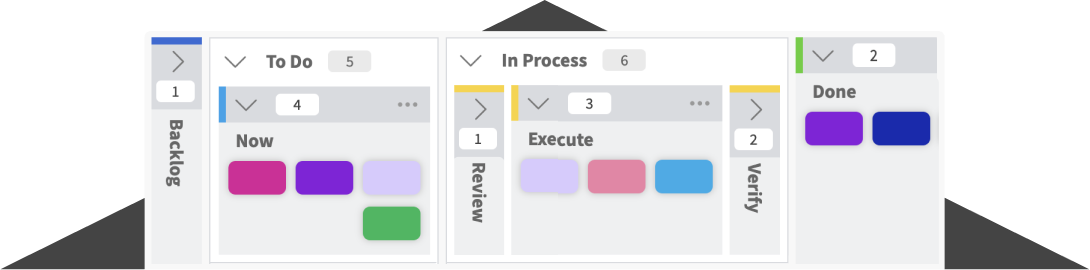

Task Management Software

Some of the most common project management tools for tax professionals include Kanban Zone, Trello, Asana, and Monday.com. Tax preparers and other tax professionals using the web-based software from Intuit.com can attest that it enables them to plan their work better. These platforms allow users to generate a list of tasks, work schedules, and time frames for completing the tasks.

Elements like project boards, tasks, and checklists allow one to envision current projects and individuals’ work. This approach will enable professionals to avoid forgetting about specific pending functions while at the same time being confident that all the tasks have been reviewed.

Document Management Systems

Document management is also essential in the tax profession since documents are involved in almost every step of the process. Examples of such technologies include DocuSign or Adobe Acrobat, which can be used to enhance such a process. This means that these tools enable document storage, document sharing, and document signing with the necessary level of security. They also help in the quick and orderly arrangement and retrieval of documents so that all the required papers are available and updated. The time saved when managing documents will allow tax professionals to spend sufficient time on other tasks.

Better Strategies to Complete Work Successfully

Effectively managing work requires not just hard work but intelligent strategies that can help maximize productivity and ensure all tasks are completed efficiently. Among various techniques, time blocking has proven to be particularly effective for many professionals, especially those in demanding fields such as tax consultancy.

Time Blocking

Time blocking is a technique that involves fixing specific periods for definite tasks or actions. This way, the focus is maintained, and no additional interfering factors could hinder the process. For instance, by dedicating particular hours of the day to a specific type of work, whether meeting with clients, writing documents, or conducting research, a tax professional can guarantee that each work type will get the necessary attention. Regarding the organizational aspect, time blocking also assists in forming a structure of the daily routine, thus contributing to productivity and lessening stress.

The Pomodoro Technique

The Pomodoro Technique is a time management concept that involves 25-minute intervals of concentrated work and short breaks. This technique can help tax professionals concentrate and not develop stress or stress out. In this manner, individuals can avoid the effects of burnout and get their work done efficiently by focusing on the various parts of a significant task and taking short breaks in between.

Prioritization and Delegation

The most important aspect of task management is classifying tasks that allow one to tell the difference between essential and urgent tasks. The Eisenhower Matrix is a valuable tool for this purpose, helping professionals categorize tasks into four quadrants: It can be categorized into four quadrants, namely the quadrant of urgent and essential, the quadrant of important but not urgent, the quadrant of not urgent but essential, and the quadrant of not urgent and also not necessary.

In prioritizing the tasks, tax professionals can meet the crucial tasks when due, and hence, they can work a lot on the critical and due tasks. Further, when working with other people or personal assistants, it is necessary to divide all tasks into groups and assign them to different members of the team or an assistant to avoid missing some tasks.

Continuous Learning and Adaptation

The tax area is dynamic, with constant changes in legislation and other acts and regulations. Learning is an ongoing process, and staying abreast of developments in the field for productivity is vital. Tax professionals should attend workshops, webinars, and training sessions, most often to stay in touch with changes. In this way, knowledge updates assist professionals in giving appropriate advice at the right time.

Conclusion

Time and task management are crucial for tax professionals to continue delivering quality outputs and ensuring their client’s needs are adequately met. People can use tech tools like Kanban Zone and time management strategies such as time blocking and the Pomodoro Technique to increase work efficiency and avoid burnout. This way, the specialists can be sure they understand what is necessary to do shortly and what they must know due to the constant tax updates. When adopted, These tools and techniques will enhance productivity and guarantee success in the complex world of taxation in the long run.

This was a guest blog. Please review our guest blog disclaimer.

Learn to Work Smarter, Not Harder!

Get our top articles weekly.

Table Of Contents

Discover many more posts…